Government and SAA debacle is collapsing South Africa’s aviation sector

On Monday 26 July, South Africans were informed that the Mango Airlines and South African Airways boards and their shareholder, the Department of Public Enterprises (DPE), have eventually decided to place their low-cost carrier Mango into business rescue. This not only has serious implications for the R819 million syphoned from SAA’s business rescue allocation, but also raises concern about the fiduciary responsibilities and conduct of the SAA and Mango boards, and the DPE.

The issue of Mango needing to go into business rescue was raised by the airline’s executive management in May 2020 – a few months after the coronavirus began to wreak havoc on the aviation industry. According to information provided to the DPE, Mango was effectively bankrupt, yet its management were told to be patient and continue operating.

Nearly a year later, on 16 April 2021, (according to an affidavit presented to court by Mango’s labour unions on 24 July 2021), Mango’s board resolved to put the airline into business rescue. This was supported by SAA’s board, which forwarded the resolution to DPE for approval.

After nearly 14 months of prevarication, delay and frustration, it took the Mango Pilots’ Association (MPA), the SA Cabin Crew Association (SACCA) and NUMSA unions to force the hands of SAA’s board and DPE. Had the SAA board and DPE taken prudent steps in April-May last year, when it was obvious to them that Mango was bankrupt, they could have spared Mango’s staff months of unnecessary anguish over receiving partial or no salaries since then.

DPE knew Mango was in severe distress when SAA’s equity partner was announced

Of greater concern is that a few weeks before Public Enterprises Minister Pravin Gordhan’s 11 June 2021 announcement that the Takatso consortium is the intended strategic equity partner (SEP) for SAA, the Minister and/or his department were aware of the Mango board's resolution of 16 April that sought to place Mango in business rescue, and the SAA board's support for this.

Furthermore, on 28 April, whilst SAA and Mango were awaiting the DPE’s decision on their call for Mango’s business rescue, one of Mango’s creditors (Aergen Aircraft Five Ltd) served Mango with a liquidation application, again raising serious concerns over Mango’s solvency and liquidity.

Conflicts and contradictions

DPE’s motivation to Parliament’s Standing Committee on Appropriations (SCOA) in May 2021, for the approval of R2.7 billion of the SAA’s already approved R10.5bn business rescue package bailout to be diverted to SAA’s subsidiaries – of which R819m was destined for Mango – was done on the basis that Mango was crucial to SAA’s wellbeing and must be saved.

Yet, on 11 June, despite the fact that the authorisation of that reallocation (in the Special Appropriation Bill) was well underway in Parliament, when Minister Gordhan announced Takatso as SAA’s equity partner, he indicated that “as part of the due diligence process, the DPE and the Consortium will carry out a joint assessment on the future of the subsidiaries”. This raises more concern about whether the R819m earmarked for Mango was ever going to reach its destination, which had this happened very soon after the Special Appropriation Act was signed and gazetted on 28 June, may have averted the liquidation application.

Possible conflict with SAA’s private equity partner

And what will become of Lift, the low-cost airline which forms part of the Takatso consortium? Will SAA’s planned strategic partner retain its current shareholding of Lift, to compete with both SAA and Mango on domestic routes? In which case, some might argue that it would be in both the new SAA and Takatso’s interests if Mango folds, leaving them with more space for SAA and Lift to grow their share of the market. This development might suggest that Mango is being set up as the sacrificial lamb for the Takatso deal, with Mango’s creditors (including their staff) being compromised and the R819m will be used as post-commencement funding to clean out Mango and set it up for a possible merger with Lift. Should this take place, one might very well argue that the parliamentary process to approve the Special Appropriation Act has been abused, in order to facilitate a private transaction, which would be seen as a creative and immoral use of taxpayers’ funds in a highly dubious, if not a corrupt transaction.

State airlines, a burden to the taxpayer and the aviation industry

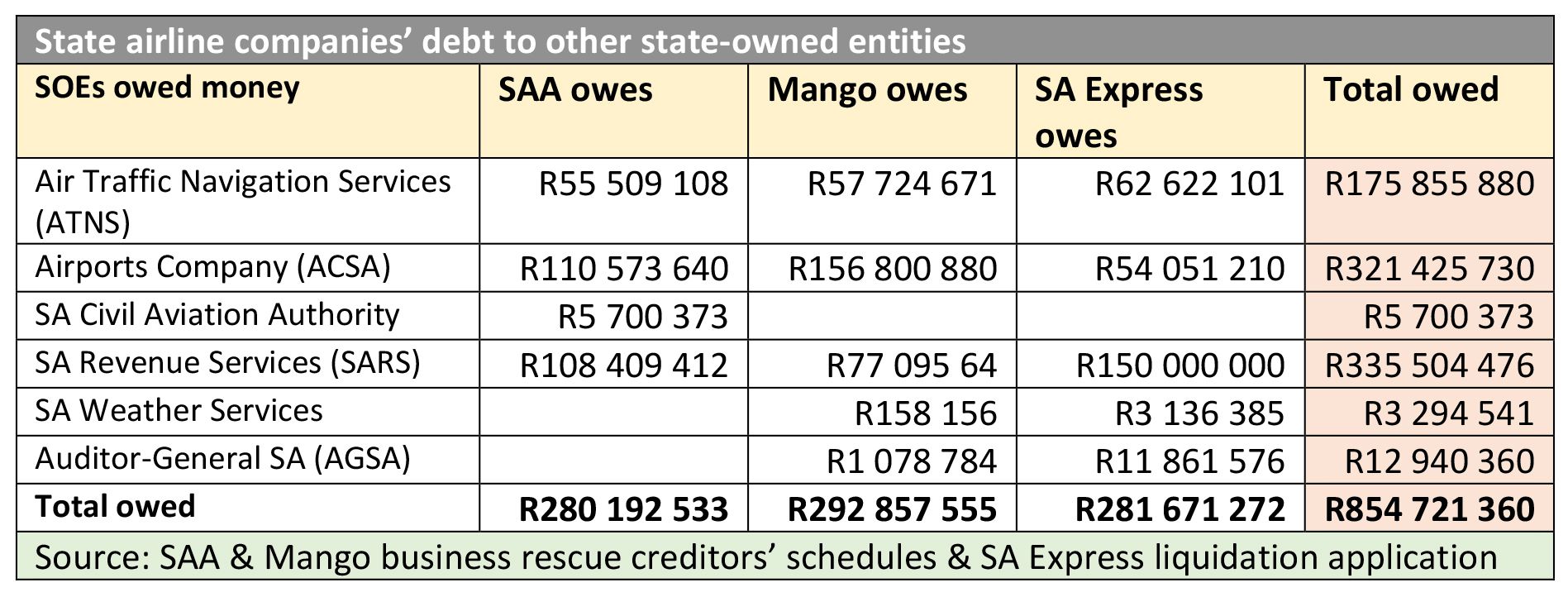

The table below (see at end of this statement) shows how the three state-owned airline companies (SAA, Mango and SA Express) were granted extraordinary credit by racking up outstanding bills to other state-owned entities, to the value of R855m. The write-off or impairment of such debt and the recapitalisation of such state-owned entities effectively implies that the unpaid debt is funded by the taxpayer. This excludes a further R718m owed to SAA Technical for aircraft maintenance, which is another SAA subsidiary that is being bailed out by the taxpayer.

These defaults are a result of the state’s systemic mismanagement of the domestic aviation sector, providing discriminatory advantages to state-owned airlines instead of treating all participants in the market on equal terms. Such leniency displayed by these air services organisations are never afforded to the private sector airlines, where payments even one day late have led to threats of immediate grounding. Private sector airlines could argue that they are cross-subsidising the state-owned airlines, while at the same time, the taxpayer is being squeezed to bail out these SOEs.

This uneven treatment encourages the failure of the state’s own companies that provide services to the entire aviation industry. These entities may themselves need bailout or pass on their higher costs to the remaining aviation industry players, making South Africa uncompetitive.

The outstanding fees due to Air Traffic Navigation Services (ATNS) of R175m represent more than 10% of ATNS’s 2020 total revenue. Furthermore, does the R1.7bn portion of SAA’s bailout now allocated to SAA Technical (SAAT) cover the R718m owed to it by Mango and, if not, will SAAT require more funding from Treasury?

In the case of SA Revenue Services (SARS), what would happen to private companies who owed it R335m? Why are no criminal charges not being laid against the directors of the state airlines who failed to transfer staff PAYE deductions to SARS?

Still no International Air Services Council Board

The continued failure by the Department of Transport to reconstitute the International Air Services Council (IASC) to enable it to function, is being seen as a deliberate action to protect SAA’s route rights, which implies government’s hand in fostering the isolation, diminishment and uncompetitive conduct of the South African aviation industry.

OUTA believes that international aircraft lessors are now reluctant to transact with South African private airlines, on the basis that the government poses the biggest risk to private airlines who are disadvantaged by the perpetual bailouts to state-owned airlines. The ultimate losers in the collapse of the aviation industry will be the public.

Now is the time for the Presidency to intervene with urgency and for ministers, directors-general and SOE executive management to acknowledge their part in this atrocious situation, and to adopt a neutral regulatory and fair-competition approach towards air transportation in South Africa.

Soundclip

A soundclip with comment by OUTA CEO Wayne Duvenage is here.