Funding

Reflecting on OUTA’s journey and its funding model since inception in early 2012

How OUTA is Funded

OUTA's funding journey since inception in March 2012 to February 2021.

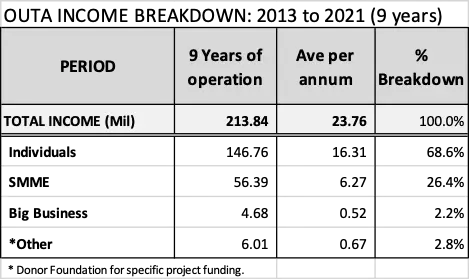

From the table below, it is clear that the bulk (95%) of our support comes from individuals (68.6%) and SMMEs (26.4%), which is not surprising because this is where OUTA’s relevance lies, ie fighting hard to defend the waste of taxpayers' funds appears to mean more to individuals and small businesses.

OUTA’s funding journey: Two distinct periods

Period 1: Four years from March 2013 to Feb 2016: The e-toll litigation period

During this initial four-year phase of OUTA’s existence, while it was named the Opposition to Urban Tolling Alliance, the organisation's work was focused purely on halting or reversing Government's decision on the introduction of Gauteng’s e-toll scheme.

During the first year of intensive litigation (March 2012 to February 2013), OUTA was largely funded by big business members of the SA Vehicle Renting and Leasing Association (SAVRALA), and a number of other NGOs and industry associations (RMI, SATSA, QASA, and SANCU).

These five entities gave rise to OUTA’s formation and agreed to drive and fund the litigation cases that unfolded between 2012 and 2013. Of the R5.6m raised in the first year ending February 2013, 80% was funded by big business and 20% from individuals.

By December 2012, various players within the State had placed sufficient pressure on OUTA’s big business funders (largely the car rental holding companies) to cease their financial and moral support of the organisation, which in turn left OUTA in a very precarious situation and with R3m in outstanding legal bills and other debt. OUTA put out a public appeal for donations to enable an approach to the Supreme Court of Appeal to appeal the judgment and shocking costs order against it, and society raised R2.5m (including R1m from the Democratic Alliance).

Period 2: Five years from March 2017 to February 2021: Broader mandate extended to opposing State corruption and e-tolls

The second period, from March 2016 until February 2021, reflects the organisation’s work under its new name as the Organisation Undoing Tax Abuse, which retained the OUTA acronym. This followed a decision in 2016 by the organisation's management – in response to calls made by many of its supporters – that OUTA takes on a broader mandate to tackle other areas of Government maladministration and corruption, whilst continuing to challenge the e-toll decision. During this period, big business was not inclined to support a civil action movement that was challenging irrational Government policy as well as corruption. This required OUTA to become more relevant to the ordinary citizen and smaller businesses who believed strongly in its work, and who were less prone to Government threats and bullying.

This fundamental shift – triggered also by OUTA’s decision to defend citizens who were summonsed by the South African National Roads Agency Ltd (SANRAL) for non-payment of e-tolls – produced a dramatic increase in OUTA’s supporter income. During this latter five-year period, while the State had not yet decided officially to pull the plug on the e-toll scheme, in March 2019 SANRAL announced it would discontinue the issuing summonses to motorists who had outstanding e-toll bills. Despite the reduced threat of litigation against motorists for e-toll non-payment, OUTA’s supporters continued contribute to the organisation’s expanded cause and its work in tackling state capture, maladministration and corruption.

During the financial years of 2019 and 2020, OUTA also received a generous donation of R5m from the Millennium Trust, which supported the development of OUTA’s Local Government accountability strategy.