City Of Johannesburg Valuation Roll

OCTOBER 2023 UPDATE

CoJ 2023 General Valuations Roll – what you now need to know now.

If you are a property owner in the City of Johannesburg you are more than likely aware that your property has been revalued as per the 2023 General Valuation Roll.

And, unless you are satisfied with the new valuation or the adjustment following your objection, you fall into one of three camps namely;

1. You have lodged an objection and it has not been adjusted to the reasonable value of your property and you only have 30 days to appeal;

2. You have objected but have not received and feedback on the objection yet; and

3. You missed the objection deadline date on 5 May 2023 and don’t know what to do.

Fortunately, depending on which camp you sit in, we have obtained some excellent resource material to help you make better decisions from this point onwards.

Why the general valuation roll matters.

Property valuations have a direct impact on the rate of local inflation for goods and services as well as financial well-being of every household.

Too, and this is not only the case in CoJ, the municipal valuations are often inflated way above the actual market value. This means, that if left uncontested, the cost of everything will rise well above the consumer price inflation (CPI) yearly average and everyone will be that much poorer.

In August we asked all city property owners to support OUTA’s call to support our petition asking the mayor and city manager to limit property valuations increases to a maximum of 9%. We had 11 914 people sign the petition and we are currently engaging with the City on the matter.

Once the objection process is finalized you will receive a notice from the Municipality and if there is a change in the valuation/categorisation, the City will backdate these changes to 1 July 2023 and adjust your invoice charges retrospectively.

Attention all property owners in Johannesburg! Are you tired of seeing your municipal rates and service charges increase every year while the quality of service from the City of Joburg continues to decline? Well, it's time to take action!

The City of Johannesburg (CoJ) has posted its General Valuation Roll (GVR) for 2023, and initial samples indicate that the new valuations are significantly higher than the real value. In some cases, they could be a few hundred percent higher than what's currently reflected on your monthly Rates and Taxes account from the City. This means that your municipal rates and service charges could increase significantly, making it less and less affordable for many residents across South Africa.

But here's the urgent part: you only have until the 5th of May 2023 to object to the new valuations if you believe they're too high. The CoJ's GVR for 2023 is open for comment right now, and you can check your property's valuation online at https://objections.joburg.org.za/. This is the ONLY opportunity you have to influence the City's valuations, so it's crucial that you take action now!

IF YOU DISAGREE WITH THE CITY OF JOBURG'S VALUATION OF YOUR PROPERTY ON THE GVR-2023 ROLL, BUT DO NOT OBJECT IN TIME (BY 5 MAY 2023), YOU WILL BE LIABLE FOR PAYING THE CITY’S NEWLY CALCULATED RATES.

WHAT DO YOU NEED TO KNOW AND DO NOW

-

Find your property on the valuation roll and check its new valuation by clicking here.

-

Compare the new value with the current value on your latest City of Joburg invoice.

-

If the new value has significantly increased, you can object to it to potentially get a reduced value.

-

If you think the new value is fair, you don't need to do anything. If the value is significantly high and you would like to object, continue with the steps.

-

If you would like OUTA to direct you to obtain a property value indication report for your property click here. (Please note this is only an indication report and should you wish to object we recommend you get in touch with a professional property valuer to assist you.)

-

To lodge a formal objection with the City of Johannesburg click here.

A guide to lodging an objection is here.

THE DEADLINE FOR OBJECTIONS HAS BEEN EXTENDED TO THE 5th OF MAY.

Disclaimer:

The intention of this page is to guide citizens and empower them regarding their rights to participate in government affairs.

It is recommended that participants make use of an accredited property valuator when lodging an objection to substantiate a legitimate and accurate objection. These professionals should also be able to assist throughout the process of the objection. Please note that OUTA will not be liable for any financial loss due to the information provided for an unsuccessful objection.

Did you know:

WHAT IS A VALUATION ROLL?

A valuation roll is a legal document that consists of all registered properties within the boundaries of a municipality and forms the rates base for the municipality.

HOW DOES THE CITY VALUE YOUR PROPERTY?

The purpose of the general valuation roll (GVR) and its supplementary rolls is to determine categories and market values for all registered properties within a municipality. The valuation is done on a pre-determined date as required in the Municipal Property Rates Act of 2004 as amended (MPRA) and uses the principle of willing buyer and seller in an open market to determine a fair price. There are several types of properties in the municipality – residential, sectional title, non-residential, agricultural etc. Each of these properties are valued using different valuation methods, although they all relate to the market value. For example, residential property (including sectional titles) are valued using the comparable sales method. Most commercial properties (including retail, offices, warehousing) are valued using the income capitalisation method, whilst institutional properties such as schools, hospitals and clinics are valued on a depreciated cost method. When valuing the properties, the municipal valuer establishes the market conditions as at the date of valuation, based on recent sales and market information in the various areas. This, therefore, takes into consideration areas where values have decreased, increased, or remained unchanged due to the current state of economy at the date of valuation.

WHAT IS THE SIGNIFICANCE OF THE DATE OF VALUATION?

When valuing the properties, the municipal valuer establishes the market conditions, as at the date of valuation, based on recent sales and market information in the various areas. The economic factors assist the valuers to determine movement in the market which could result in an increase, decrease or stagnant value being determined compared to the previous valuation roll.

WHEN WILL THE NEW VALUATIONS AND RATES TAKE EFFECT?

The effective date of implementation refers to the implementation of the general valuation roll. The implementation coincides with the new financial year of the municipality which is 1 July.

WHAT IS A SUPPLEMENTARY VALUATION ROLL?

The City is compelled by legislation to conduct supplementary valuations on all properties where a change has occurred as prescribed in Section 78 of the MPRA. For example: A vacant property that is subsequently improved with a dwelling, may have been listed in the main GVR under the vacant category and vacant value, but once developed (improved) the supplementary valuation will change the category to residential and the value would reflect the improved value of the land and improvements. For each supplementary valuation, the owner will be informed in writing of the details of such valuation by means of a Section 78 notice. The owner will have an opportunity to request a valuer to review the value if the owner is not in agreement with the value and / or category. All supplementary valuations done in a specific period will be combined in a supplementary valuation roll which will be open for inspection and objection as prescribed.

WHAT CAN I DO IF THE VALUE REFLECTED IN GVR 2023 IS INCORRECT?

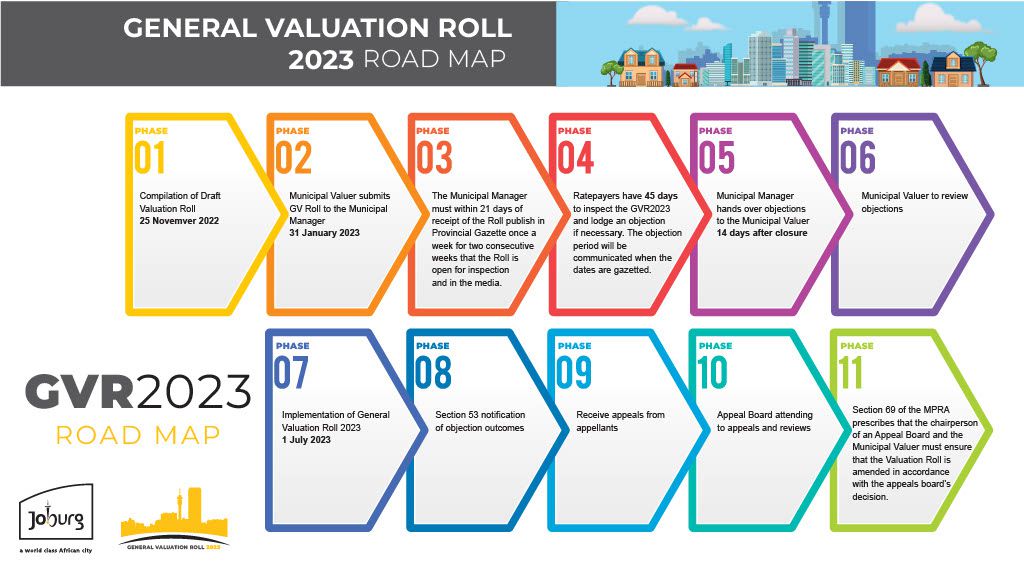

When the general valuation roll opens for inspection and objection, the customer can visit official objection centres and submit an objection to any entry in the valuation roll, during the prescribed period. The municipal valuer will issue a municipal valuers’ decision (MVD) that will be sent to the customer. If the customer is not happy with the decision, they can lodge an appeal during the prescribed period. This process for the current valuation roll was done between 20 February and 6 April 2018 so this process is closed. The anticipated objection period for GVR 2023 will be between February and April 2023. If the customer misses the opportunity to object, there is an opportunity to raise a query with the City’s valuations section. The customer should provide enough information to assist the municipal valuer in the decision-making process.

IS THE MUNICIPAL VALUER'S DECISION FINAL?

Residents who disagree with an objection outcome can lodge an appeal but must include evidence to substantiate their appeal. The Section 53 notice (objection outcome notice) will indicate the period in which to lodge an appeal as well as the venue where the appeal forms can be collected and returned before closing period. Appeals will be heard by the Valuation Appeal Board, which is an independent body appointed by the MEC for Local Government under section 56 of the MPRA. The board consists of a legal representative (an advocate or attorney) and two professional valuers registered at the SA Council for Professional Valuers. The appeal board will review and either confirm, amend or revoke the decision of the municipal valuer.

WHAT IF THE MUNICIPAL VALUER CHANGES THE VALUE BY MORE THAN 10 PERCENT?

If the municipal valuer changes the value by more than 10 percent upwards or downwards, the Section 53 notice (objection outcome notice) will indicate whether a compulsory review is applicable. A compulsory review by the Valuation Appeal Board will apply in terms of Section 52. The board will review and confirm, amend or revoke the decision of the municipal valuer. It is therefore very important that property owners read the Section 53 notice that reflects the outcome of the objection and whether the value increased or decreased by more than 10%.

WHY DOES THE MUNICIPAL MARKET VALUATION DIFFER FROM THE ESTATE AGENTS' VALUATION?

The date of valuation refers to the date at which property values are determined and is fixed for the purpose of GVR 2023 as 1 July 2022. Estate agents determine the value of a property as at today’s market which might differ significantly from the market of 1 July 2022.