Ekurhuleni Valuation Roll

Ekurhuleni's property valuation roll is out for public comment. This valuation determines residents rates and taxes until 2025.

OUTA has been alerted to concerning escalations in municipal property evaluations from concerned Ekurhuleni residents. These escalations will significantly increase Ekurhuleni residents monthly rates bills. Some residents have noted that their rates bill will increase by more than R2000 per month.

The Bedfordview Residents' Action Group (RAG) has informed OUTA that many of the 500 residents they represent have been adversely affected by the new general valuation roll, RAG is currently lodging objections on these residents' behalf.

OUTA has been informed that the general valuation roll contains sufficient errors to make it reviewable.

The public has until 18 June 2021 to lodge formal objections.

The general valuation roll will affect residents rates from 1 July 2021.

Did you know:

A valuation roll is a database of all properties within a municipality’s jurisdiction. This data includes the property description, details of the property owner as well the market value of the property as determined by the municipality.

General valuation rolls are usually published every four to five years.

The entries on a valuation roll include the market value of a property as determined by the municipality. The market value of a property may differ (increase in most cases) from the previous valuation.

It is the value of the property as reflected on the valuation roll that is used by the municipality to determine the property rates payable. An increase in market value of a property means an increase in property rates payable.

It is the responsibility of a property owner to confirm the accuracy of the market value as reflected on the valuation roll.

The rates policy of municipality determines the different property rates payable for different categories of properties. Such categories may include the use of the property, or the permitted use of the property, or a combination thereof (i.e. residential or agricultural properties).

In addition to the rates applicable to certain categories of properties, certain rebates are also applicable, which means that rebate amount(s) may be deducted from the market value of a property before any calculations are made to determine the rates ultimately payable.

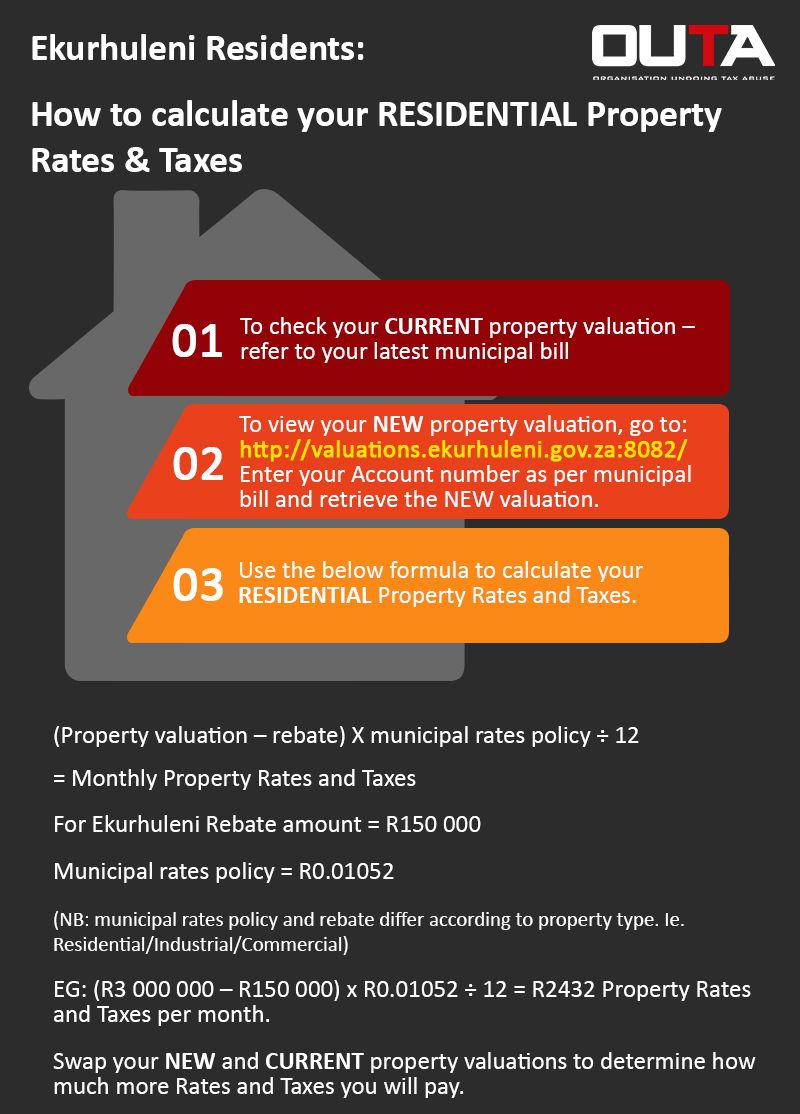

Below is an example of property rates payable for a residential property valued at R3,000,000.00 in accordance with the applicable rate as determined in the municipal rates policy (for this example, R0.01052), as well as a fictional rebate of R150,000.00 (for illustration purposes).

(R3,000,00.00* – R150,000.00**) x R0.01052*** ÷ 12****

= R2432.00*****

* property market value as per the valuation roll

** rebate applicable to the property as determined by the municipality

*** amount in cent (rate) as determined by the municipality in the municipal rates policy

**** division by 12 to calculate monthly rate payable

***** property rates payable to the municipality per month

In terms of section 50(1)(c) of the Rates Act you may “…lodge an objection with the municipal manager against any matter reflected in, or omitted from, the roll.” In this regard, the increased valuation of the property in question (if the increase in unjustified or exorbitant) qualifies as “any matter”. The relevant objection forms and procedures are obtainable from the municipality directly, alternatively from their website.

Sections 51 – 55 of the Rates Act sets out the process after an appeal has been lodged. You may also wish to consider enlisting the services of independent property consultants or valuers or even an attorney to assist you.

Should the objection be rejected and/or the appeal to the Valuation Appeals Board fails and you disagree with the outcome, you can approach the court for a review of the decision.

There are usually strict time periods applicable in order to lodge formal objections with a municipality, however, under certain circumstances an objection may be made beyond such prescribed time period. In the case of the City of Ekurhuleni’s General valuation roll for the 2021 – 2025 cycle, objections must be lodged on or before 18 June 2021.

The city of Ekurhuleni has published its 2021 - 2025 valuation roll for public comment on or before 18 June 2021.

You can view your property’s value according to the municipality here.

If you object to the value as reflected on the valuation roll, you may wish to lodge a formal objection with the municipality, the details of which may be found here.

The City of Ekurhuleni currently makes provision for the objection to be hand delivered at the locations as per the link above.

For more information on exactly why the valuation roll is problematic, see: https://citizen.co.za/news/south-africa/government/2508387/residents-up-in-arms-over-ekurhulenis-property-roll/.

OUTA has engaged with the Bedfordview Residents Action Group (RAG) and confirmed that a many residents are concerned about their escalated property rates. RAG represents only approximately 3% of all Ekurhuleni residents. OUTA believes that this problem affects many more Ekurhuleni residents, many of whom are unaware of these proposed property rates.

OUTA is joining forces with various interest groups, including the RAG in order to mobilise Ekurhuleni residents and plead with the municipality to retract and reconsider the valuation.

OUTA is committed to addressing the irregularities behind the valuation roll and is considering possible legal and other actions, should the City of Ekurhuleni not rectify its errors before 1 July 2021. Should we receive a significant number of replies to our survey, this will strengthen OUTA's possible case against the municipality.

What you can do

- If you submitted your formal objection before 18 June 2021, you have taken the necessary steps to resolve your issue. Ensure that you obtained a reference number.

- However, in order to safeguard against the cutting of services while your objection is being tended to, it is recommended that you declare a dispute with Ekurhuleni. OUTA and RAG recommends the following dispute letter (available here), but you are at liberty to tender any amount which you deem fair. This amount elected is payable pending the outcome of your objection.

- After you have completed your dispute form, submit it to: Lereku.Leku@ekurhuleni.gov.za and Imogen.Mashazi@ekurhuleni.gov.za, where after you are likely to receive a response advising you on credit control measures and flagging of your municipal account. Unfortunately, there is no definitive date on the outcome of your objection. Upon the outcome of your objection, Ekurhuleni has an obligation to adjust your account.

- Ekurhuleni stated publicly that all accounts for which objections have been received before 18 June 2021 will be flagged. In this regard, see here what Ekurhuleni had to say.

- From our observation, this is not guaranteed. You may wish to confirm with Ekurhuleni that your municipal account has been flagged.

- If you failed to lodge your objection by 18 June 2021 or if you only found out about your escalated property value now, you are not the only one.

- Although you cannot object to the general valuation roll in the strict sense, as the time to do so has lapsed, the issue of your escalated property value may still be addressed.

- This option is not ideal, but it is unfortunately the only means available for your you to address the issue after the fact. In terms of section 78 of the Local Government: Municipal Property Rates Act, 2004, a municipality is obliged to publish a supplementary valuation roll where properties have been valued incorrectly (see the full section for instances where supplementary valuation rolls are to be published).

- In this regard, it is recommended that a query to this effect be submitted to Ekurhuleni, highlighting your concern – in most cases, the exorbitant increase of your property’s market value. Your argument needs to be supported by documentary proof as to why your property market value has been increased exorbitantly and why Ekurhuleni “got it wrong”. Examples of such documents are valuations conducted by valuers and property consultants. There are many property consultants throughout Ekurhuleni that offer these services and would even submit the section 78 query on your behalf, albeit at a fee.

- In essence, the query ought to inform Ekurhuleni to amend your property market value to the true market value (as per supporting proof) when it publishes the supplementary roll. When exactly such supplementary roll will be published is unclear. However, this should happen at least once a year.

- Once Ekurhuleni receives your “query”, section 78(5) of the Act allows it to re-value or re-categorise a property by merely notifying a property owner. Upon receiving this notice, you are at liberty to accept the value as indicated in the notice and pay the rates accordingly, or you may wish to challenge this valuation and submit a review letter to Ekurhuleni. Your review is not automatic, and Ekurhuleni may decline. You may also elect to do nothing and wait for the publication of the supplementary valuation roll and only challenge it at that stage.

- Unfortunately, you remain liable for the amount reflected on your municipal account according to the market value of your property on the general valuation roll until such time that the supplementary valuation roll is published with the effected amendments. Should the supplementary valuation roll be published and not rectify your property’s market value, or if you received an unfavourable section 78(5) notice and did not submit a review letter, you will then have an opportunity to formally object to the supplementary valuation roll.

- Once you receive notice from Ekurhuleni that your objection was unsuccessful (therefore rejected), you have an additional avenue to exhaust before approaching the court.

- In terms of the Local Government: Municipal Property Rates Act, 2004, you may lodge an appeal with the Valuations Appeal Board, which is an independent body. Note that an appeal must be lodged within 30 days upon receipt of the notification that your objection was unsuccessful.

- Depending on the next sitting of the Valuations Appeal Board, your appeal will be heard, followed by a notification that your appeal has either been rejected or accepted. The Valuations Appeal Board will inform you of the outcome.

- If you are not satisfied with the outcome of the appeal, you may wish to consider enlisting the services of an attorney and institute court proceedings to review the Valuation Appeals Board’s decision.

- The relevant forms for purposes of lodging an appeal may be obtained from Ekurhuleni directly.

How can you get involved:

In order to understand how many residents this problem affects, we are running a survey for all Ekurhuleni property owners.

This survey also provides us with your mandate to proceed with possible legal action, should we see fit to do so. Please complete this survey and encourage other Ekurhuleni property owners to do so too.