Campaigning for reduced fuel levies

In July 2018, OUTA started calling for the reduction of the general fuel levy by R1 a litre.

OUTA believes that the burden of high fuel levies, which impact on the high fuel price, is the direct result of the past decade of corruption and abuse of public funds.

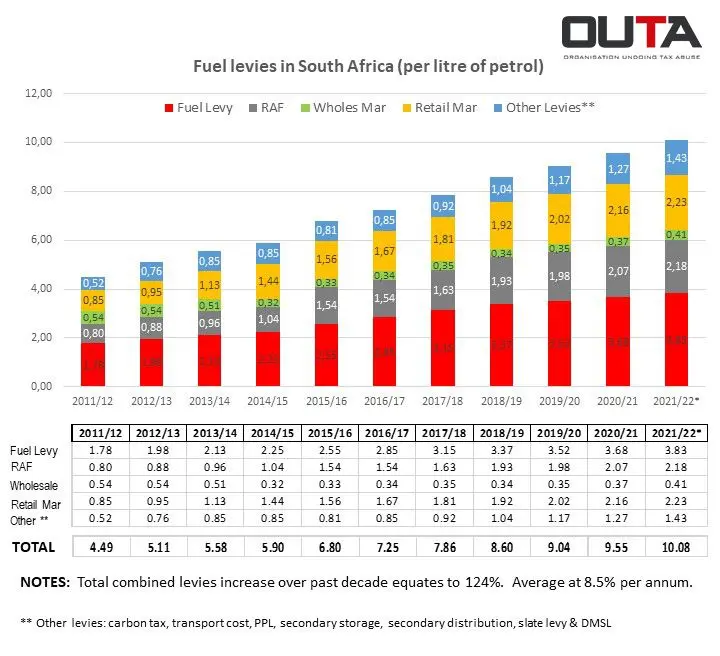

By October 2018, the price of fuel had reached record highs (R17.08 per litre of 95 ULP inland). This is due to three main factors: the international price of oil (about $80 a barrel in October 2018), the weak rand, and the fuel levies. The last time the price of oil was at the current level of close to $80 per barrel was four years ago in October 2014, however at that time the price of fuel was R13.61, due largely to a stronger rand at R11.18 to the dollar compared to R14.69 to the dollar in September 2018. In addition, the combined General Fuel Levy and Road Accident Fund levy were a lot lower at R3.28 per litre, compared to R5.30 by October 2018.

The price of fuel affects everything including the price of food.

By 2022, government acknowledged public anger and despair over the cost of living. In February 2022, for the first time in more than a decade, the fuel levies were not increased. Months later, a temporary reduction in the general fuel levy was implemented for a few months. In February 2023, the fuel levies were again not increased.