SANRAL misleads once again with 17% cost claim

E-toll collection and administration systems in the US, for example, cost just over 5%. As Wayne Duvenage, OUTA Chairperson says “17% is simply excessive, unacceptable and well outside any reasonable benchmark” More enraging, is the fact that, SANRAL only speak of the e-toll related capital and operations expenditure and conveniently leave out the Violations Processing Centre (VPC) and other operational costs related to e-toll collection.

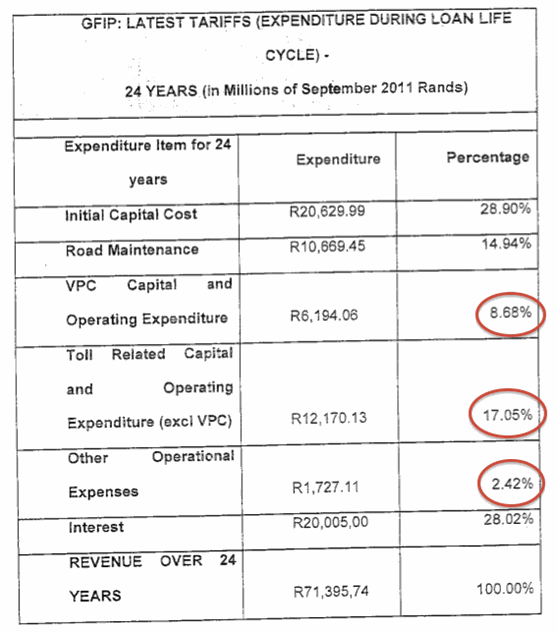

The table below was included in SANRAL’s affidavit of e-toll cost breakdown provided by SANRAL during the past court challenges with the Opposition to Urban Tolling Alliance (OUTA). The toll related costs “excluding the VPC” reflect a cost of R12,2bn over 24 years, i.e. 17% of the R71bn generated by toll collections. This figure also differs significantly from earlier figures submitted by Treasury during the same court challenge.

From this table attached, one can see that a further R6.2bn (or 8,7%) for the VPC process and another 2,4% of other operational expenses. The obvious question is why exclude these figures from the total e-toll collection process? SANRAL have stated in the past that these will be covered by revenues generated from the higher “alternate” rates. One must assume that the “alternate tariff” revenues are included in the R71bn and if not and if not, why then do they show the VPC costs are reflected as 8.7% of revenue? Does SANRAL imply that all defaulters revenues will be collected using the higher rates? And what if it isn’t? Who picks up the debt? What is the expected ratio of bad debt to total revenue?

Normally, business reflects all revenues and the costs related to chasing or writing off debt is integral to the overall business is reflected and cannot be ignored, as SANRAL is doing here.

To further indicate SANRAL’s smoke and mirrors on this issue, Kapsch TrafficCom- an 85% shareholder in the ETC JV - recently announced that income generated by e-tolling for them will be a minimum of €50m (i.e. R670m) per annum. This amounts to over R16bn over the same 24-year period used by SANRAL. This alone is some 22% of the R71bn e-toll revenues and well over the 17% indicated by SANRAL. Who’s misleading who here? If Kapsch’s figures are misleading, then SANRAL ought to warn them of this, as there are massive and highly punitive fines when misleading investors in this way.

Note, please see the table of GFIP e-toll tariff revenues and expenditure - as supplied by SANRAL.